Clear, buyer-first advice for anyone considering a static caravan holiday home on the Mid Wales coast.

You've found the perfect spot overlooking Cardigan Bay with golden sandy beach just yards away.

You can already see yourself sitting on the decking, watching the sun set over Cardigan Bay, a cup of tea in hand or a glass of wine on the table.

Then someone mentions insurance.

It's the practical part of the dream. But getting the right static caravan insurance means you can relax when the winter weather rolls in, knowing your investment is protected.

Key Facts: Static Caravan & Lodge Insurance at a Glance

| Question |

Short Answer |

| Is it legally required? |

No law requires it, but park licences usually do. |

| Does it cover storm damage? |

Yes. Standard policies cover storm and wind damage. |

| Are contents insured? |

Usually optional. Check your specific policy. |

| Is liability included? |

Yes. Most parks require £2m–£5m liability cover. |

| Can I insure older units? |

Yes. But "New for Old" cover may not be available. |

| What if I let it out? |

You need specific cover. (Note: Glan Y Don is owners-only). |

| Can I use any insurer? |

Generally yes, as long as cover meets park rules. |

What This Guide Covers

- Cover: What is actually protected.

- Values: Static caravans vs lodges.

- Costs: What influences your premium.

- Claims: The drain-down requirement.

- Providers: Who to call for a quote.

- Checklist: Questions to ask before buying.

1. Why Insurance Matters for Your Holiday Home

You don't buy a holiday home to worry about paperwork.

You buy it to escape.

But the reality is, nature happens. Atlantic storms roll in from the Irish Sea. Coastal winds pick up. Pipes freeze in January.

This guide cuts through the jargon to tell you exactly what you need to look for in a policy if you're buying on the Mid Wales coast.

When the unexpected happens, you want one thing: a simple phone call that sorts it out.

2. How Static Caravan Insurance Works

The basics explained

Static caravan insurance is a specialist product.

Unlike car insurance, it isn't mandated by UK law. However, almost every holiday park pitch licence requires it.

There are two main ways your holiday home can be covered:

New for Old: If your caravan is destroyed (e.g., by fire or storm), the insurer replaces it with a brand new equivalent model. This is the gold standard but costs more.

Market Value: The insurer pays what your caravan was worth the day before the incident. This is cheaper, but if you have an older unit, the payout might not be enough to buy a replacement.

Why standard home insurance won't work

Home insurance is for bricks and mortar. It won't cover a structure made of timber and aluminium.

Touring insurance is for caravans that move on the road. It won't cover a static unit that sits on a pitch all year.

You need specific "Static Caravan" or "Holiday Lodge" insurance.

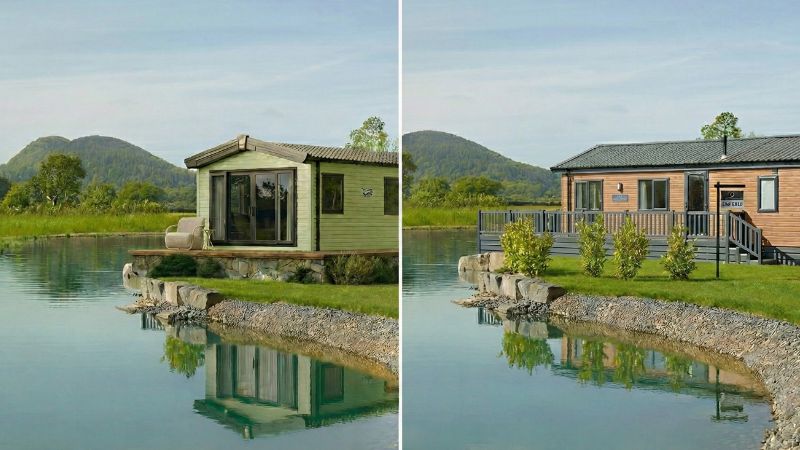

3. Caravans vs Lodges: What's Different?

While they serve the same purpose, insuring a lodge is slightly different from insuring a caravan.

Higher values for lodges

Lodges are built to residential standards (BS3632). They are larger, better insulated, and often sit on substantial decking.

This means the "Sum Insured" will be much higher. If you have a luxury lodge at Glan Y Don, ensure your policy covers the full replacement cost, including the decking and skirting.

New for Old limits

Because lodges last longer, insurers often offer "New for Old" cover on them for up to 20 or 25 years.

Standard static caravans might only get this cover for 10 or 15 years before moving to "Market Value."

4. What Your Policy Typically Covers

Weather damage

Mid Wales is beautiful, but the weather can be dramatic.

Most comprehensive policies cover:

- Storm damage to roofs and skylights.

- Wind damage (important for any coastal location).

- Falling trees or branches.

Theft and vandalism

This covers break-ins and malicious damage.

Insurers appreciate parks like Glan Y Don because we are secure and owners-only. Be sure to mention the park's security measures to potentially lower your premium.

Public liability

If a visitor trips on your decking step, you could be liable.

Most parks require you to have at least £2 million in Public Liability cover. This protects you against legal claims from third parties.

5. What Influences Your Premium?

Location considerations

Insurers rate every park based on its postcode.

- Coastal: Wind and salt air are factors.

- Riverside: Flood risk.

- Inland Countryside: Generally lower risk, but frost is still a consideration.

Glan Y Don is located on the coast near Tywyn. While our pitches are well-maintained and sheltered, insurers will factor the coastal location into their quote.

Age and condition

Older units may cost more to insure because parts can be harder to source, and they may be more susceptible to weather over time.

Usage: The "Owners-Only" Advantage

This is where Glan Y Don owners benefit.

Insurers charge extra for parks that allow commercial subletting (holiday rentals) because guests can be higher risk than owners.

Because Glan Y Don does not allow subletting, your premium should be lower than on a commercial park. Make sure your insurer knows this.

6. Understanding the Claims Process

The Winter Drain-Down Requirement

This is the single biggest cause of rejected claims in the UK.

Mid Wales winters can get cold. If water is left in your pipes when the park is closed (or when you aren't there in winter), it can freeze and burst the pipes.

Important: Most policies state you must "drain down" the water system between November and March if the unit is unoccupied. If you don't, and a pipe bursts, the claim may not be covered.

At Glan Y Don, we offer a drain-down service to help you comply with this requirement.

What to do when something happens

- Stay safe: Do not enter if there is structural or electrical damage.

- Mitigate: Turn off the gas and water if it is safe to do so.

- Document: Take photos before you clean anything up.

- Notify: Tell the park team immediately so we can help secure the unit.

7. Finding the Right Provider

Types of provider

Specialist Brokers: Companies like Leisuredays, Caravan Guard, or Towergate specialise in this market. They understand park rules and drain-down clauses.

General Insurers: High street banks often offer "holiday home" insurance, but check the small print carefully. They might not cover park-specific items like decking or skirting.

Park rules

At Salop Caravan Sites, we don't require you to use a specific insurer. You are free to shop around.

We just ask to see a copy of your certificate to ensure the Public Liability cover meets our park standards.

8. What's Changing in 2026

Climate considerations

Insurers are paying out more for weather events. Premiums may rise slightly across the industry, particularly for coastal locations.

Flexible cover options

Policies are becoming more flexible. You can often choose to insure just the structure, or add contents, gadgets, and sports equipment (useful for golf clubs or outdoor gear) as extras.

9. Your Pre-Purchase Checklist

Use this checklist before you commit to a policy:

☐

Values: Does the sum insured cover the cost of a brand new replacement + decking?

☐

Liability: Does it meet the park's £2m–£5m requirement?

☐

Winter: Do you understand the drain-down rules?

☐

Usage: Does the insurer know this is an owners-only (no subletting) park?

☐

Weather: Is storm and wind cover definitely included? (Important for coastal locations).

10. Common Questions Answered

How much does static caravan insurance cost?

It varies, but for a standard unit in a coastal location, expect to pay between £150 and £350 per year. Lodges will cost more due to the higher rebuild value.

Is static caravan insurance a legal requirement?

No, but it is a requirement of the Glan Y Don licence agreement. You must have it to keep your caravan on the park.

Do I need different cover if I let my caravan out?

This doesn't apply at Glan Y Don. We are an owners-only park, so you do not need commercial hire-and-reward insurance. This often keeps your premium lower.

What happens if I don't drain down in winter?

If your policy requires it and you don't do it, any damage caused by frozen pipes may not be covered. It's the most common reason for claim issues.

Does insurance cover my golf clubs or outdoor equipment?

Standard contents cover might have a limit per item (e.g., £250). If you have expensive equipment, check the policy limits or add them as specified items.

Can I choose my own insurer?

Yes. Glan Y Don allows you to choose your own provider, provided they meet our minimum liability standards.

11. Peace of Mind, Sorted

Insurance isn't the exciting part of buying a holiday home. But it is what lets you enjoy the exciting parts without worry.

When the Atlantic winds blow or the frost arrives, you want to know you're covered.

Get it sorted once, understand the drain-down requirement, and then forget about it. That's the goal.

The beach walks, the uninterrupted sea views across Cardigan Bay to Happy Valley and Cadair Idris, the escape — that's what you're here for.

Why Choose Glan Y Don?

A 5-star beachside park with uninterrupted sea views, recently redeveloped, and just 66 pitches across 4 areas, on a level ground just yards from Tywyn Beach, with golden sandy beach just yards away.

- Glan Y Don: Wake up to uninterrupted sea views across Cardigan Bay.

- Peaceful Setting: Perfect for couples and those seeking quiet (children welcome in school holidays).

- Owners Only: No subletting — a true community of just 66 owners.

- Long Season: Enjoy your holiday home from 1st March to 2nd January.

- Facilities: Gymnasium, DVD/Video suite, book library, laundrette, dog wash, WiFi.

- On-Site Support: Jonathan and Michaela are here to help with anything you need.

Request your free brochure today to see our latest plots.

Glan Y Don at a Glance

| Feature |

Details |

| Location |

Tywyn, Mid Wales (Glan Y Don) |

| Season |

1st March – 2nd January (10 months) |

| Site Fees (2026) |

£4,970.16 (Single), £6,120.16 (Twin) |

| Subletting |

No (Owners, Family & Friends only) |

| Facilities |

Gymnasium, DVD/Video suite, book library, laundrette, dog wash, WiFi |

| Nearby |

Aberdovey Golf Club, Aberdovey Beach, Snowdonia |

| Park Size |

66 pitches (intimate, exclusive) |